Unlocking the Power of Expert Advisors in MT5: Revolutionizing Automated Trading

24/7 Trading: Financial markets operate globally across different time zones. EAs can monitor markets and execute trades around the clock, even when traders are asleep or offline. This feature is particularly beneficial for capturing opportunities in volatile markets.

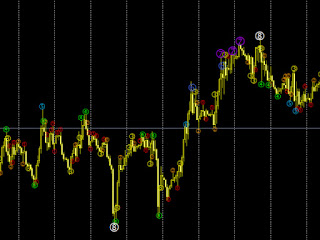

Backtesting Capabilities: MT5 offers powerful backtesting Expert Advisor MT5 tools that allow traders to assess the viability of their trading strategies using historical data. This feature helps traders refine their EAs and optimize their parameters before deploying them in live markets.

Diversification: EAs can simultaneously execute multiple strategies across various financial instruments. This enables traders to diversify their portfolio and reduce risk by not relying solely on a single trading approach.

Efficiency: With EAs, trades are executed instantly as soon as predefined conditions are met. This eliminates delays caused by manual intervention and ensures that traders don't miss out on time-sensitive opportunities.

Creating and Deploying Expert Advisors

Developing an effective EA requires a combination of technical expertise and a deep understanding of trading strategies. The process involves:

Strategy Definition: Traders need to clearly define their trading strategy, including entry and exit conditions, risk management rules, and any other relevant parameters.

Coding: EAs are typically coded using programming languages like MQL5, which is specific to the MT5 platform. The code should accurately reflect the trader's strategy and logic.

Testing and Optimization: EAs must be thoroughly tested using historical data to ensure their effectiveness. Traders can use MT5's backtesting tools to identify potential issues and optimize parameters for maximum performance.

Deployment: Once satisfied with the EA's performance, it can be deployed in live trading conditions. Traders should continue to monitor its performance and make adjustments as necessary.

Challenges and Considerations

While EAs offer numerous benefits, there are also challenges that traders should be aware of:

Market Dynamics: Financial markets are influenced by a wide range of factors, including geopolitical events and economic indicators. EAs may struggle to adapt to rapidly changing market conditions.

Over-Optimization: It's possible to over-optimize an EA based on historical data, leading to poor performance in live markets. Striking the right balance between historical performance and adaptability is crucial.

Technical Issues: EAs are dependent on stable internet connectivity and reliable platforms. Technical glitches can lead to missed opportunities or erroneous trades.

Constant Monitoring: While EAs can operate autonomously, they still require periodic monitoring to ensure they're functioning as intended. Traders should be ready to intervene if necessary.

Conclusion

Expert Advisors have transformed the landscape of automated trading in MT5, offering traders the ability to execute strategies with precision, efficiency, and consistency. These algorithmic tools have opened new avenues for traders to navigate the complexities of financial markets, while also presenting challenges that require careful consideration. As technology continues to evolve, the role of EAs in shaping the future of trading is set to become even more prominent, and traders who harness their power effectively stand to gain a significant edge in the markets.

Comments

Post a Comment